“What would you do if someone close to you was taken hostage overseas? Would you know how to respond?” It’s a chilling thought that most of us push aside. But for some, it’s an all-too-real possibility. Kidnap and ransom cases are on the rise globally, with reported incidents increasing by 93% in certain high-risk regions over the past decade. Are you prepared for such a crisis?

This post will guide you through everything you need to know about kidnap and ransom insurance—specifically tailored for crisis response situations. From understanding coverage options to handling emergencies like a pro, we’ve got answers to your FAQs (and maybe even questions you didn’t think to ask). By the end of this article, you’ll feel equipped to make informed decisions about protecting yourself or your business when things go south. Let’s dive in.

Table of Contents

- Key Takeaways

- Background on Kidnap and Ransom Insurance

- Step-by-Step Guide to Securing Coverage

- Best Practices for Crisis Response

- Real-Life Examples

- Frequently Asked Questions (FAQs)

Key Takeaways

- Kidnap and ransom insurance provides financial protection and expert support during hostage situations.

- This type of policy is especially vital for frequent travelers, expats, and international businesses operating in unstable regions.

- A well-planned crisis response strategy includes knowing who to call, understanding policy terms, and remaining calm under pressure.

- Not all policies are created equal—watch out for exclusions and fine print!

- Prevention tips like avoiding risky areas and maintaining low-profile behavior can reduce your exposure to threats.

Why Kidnap and Ransom Insurance Matters

The Hard Truth: No one plans to be kidnapped, but bad actors absolutely do plan abductions. These criminals often target individuals perceived as wealthy, influential, or easy prey. In fact, did you know that nearly 75% of kidnapping victims are employees working abroad? Yikes.

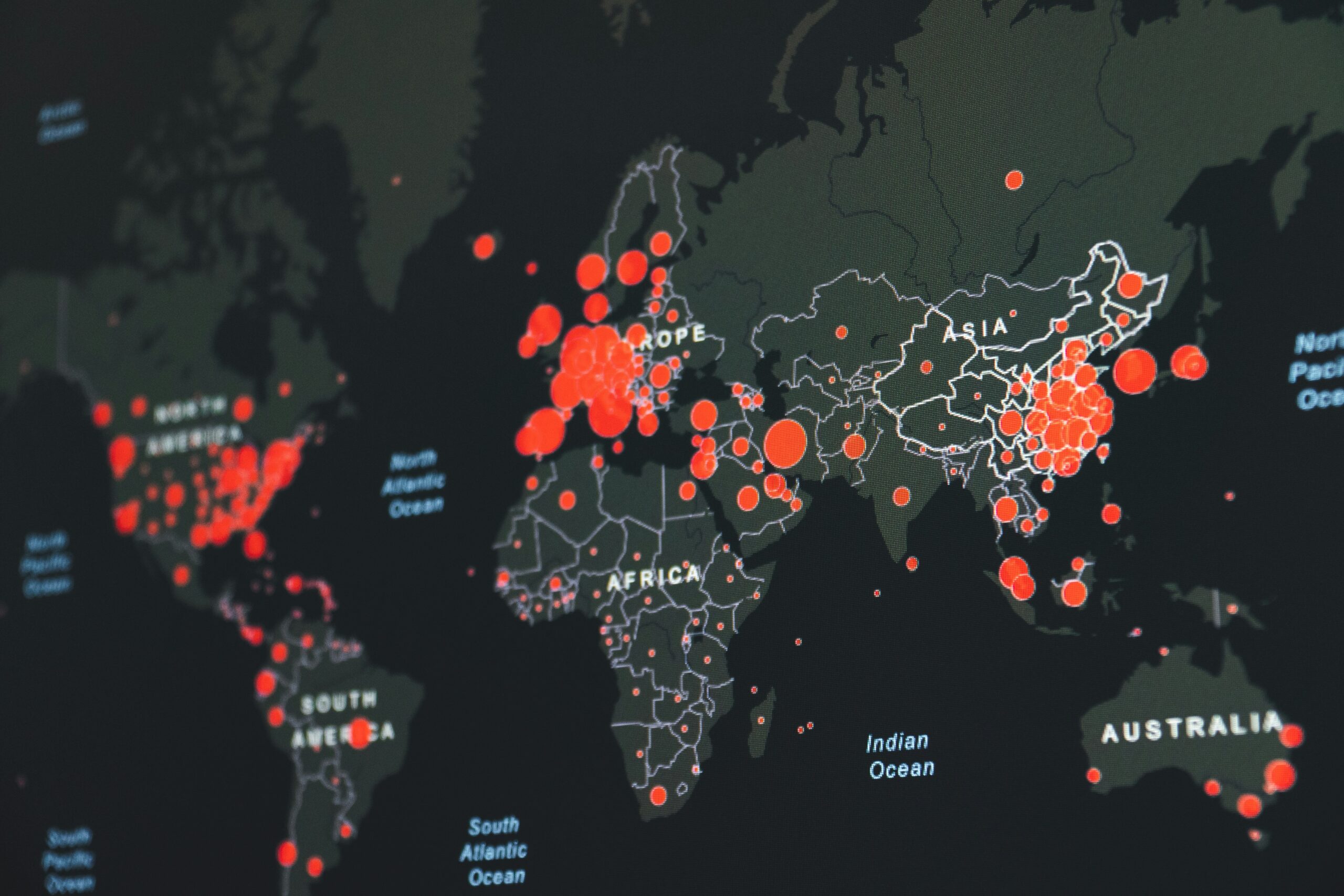

Figure: Global Kidnapping Statistics Over Time

Here’s a confessional fail: A couple of years ago, I advised a friend against buying this type of insurance because it felt “too paranoid.” Spoiler alert—they were eventually deployed to a volatile region without any backup plan. Thankfully, nothing happened, but they came back shaking their heads. Moral of the story? Don’t skimp on preparation just because danger feels distant.

This insurance isn’t just for corporations—it’s also available for individuals, families, and solo entrepreneurs venturing into risky territories. Essentially, it helps cover expenses related to ransoms, negotiations, medical care, and sometimes even psychological counseling afterward. Oh, and don’t forget—the professionals included in these policies aren’t amateurs; they’re former military operatives, hostage negotiators, and top-tier crisis managers (*chef’s kiss*).

How to Secure Kidnap and Ransom Insurance Like a Pro

Alright, let’s walk through securing this critical coverage step-by-step:

Step 1: Assess Your Risk Profile

First things first: Understand your risk level. Factors include travel destinations, profession, family background, and visibility. If you’re an oil rig worker in Nigeria, chances are you’re at higher risk compared to a librarian in Canada. Duh.

Step 2: Compare Providers

Don’t settle for the first quote you see. Compare providers based on factors like cost, coverage limits, exclusions, and customer reviews. Some companies offer better support networks, while others might have stricter requirements (like mandatory training sessions).

Step 3: Review Policy Details Carefully

Dig deep into those terms and conditions. Trust me—you don’t want surprises like waiting periods before the policy kicks in or limitations on covered activities (e.g., illegal acts). Read every word until your eyes glaze over like your laptop fan during a 4K render.

Step 4: Assemble Your Emergency Contacts

Who ya gonna call? Ghostbusters? Nope—your crisis management team. Make a list of contacts provided by your insurer alongside local authorities’ numbers. Keep it updated and share it with trusted family members.

Top Tips for Effective Crisis Response

No matter how solid your insurance plan is, responding effectively in a real-life emergency requires quick thinking and discipline. Here’s the scoop:

- Stay Calm: Easier said than done, right? But panicking only makes situations worse. Think of your favorite TV hero staying cool under fire—channel their energy.

- Contact Experts Immediately: Don’t try to negotiate yourself unless explicitly told to. Leave it to the pros.

- Follow Instructions: Whether from law enforcement or your insurer’s crisis team, always adhere to professional advice.

- Maintain Confidentiality: Keep communication private to avoid escalating tensions or spreading misinformation.

- Bad Tip Alert: Never carry large amounts of cash thinking it’ll deter kidnappers. Newsflash—it usually does the opposite.

Real-Life Success Stories

Let’s take inspiration from John*, a mining consultant from Australia, who found himself kidnapped in Papua New Guinea. Thanks to his company’s comprehensive kidnap and ransom policy, a specialized negotiation team was activated within hours. They secured his release within days without paying a single cent due to strategic maneuvering. Safe and sound, he returned home to tell the tale—and he immediately upgraded his personal policy.

Figure: Example Scenario Outcome Timeline

Honestly though, not having insurance is like playing Russian roulette with a loaded gun. Why risk it?

Crisis Response FAQs

- Q: Is kidnap and ransom insurance worth the investment?

A: Absolutely, if you travel frequently to high-risk zones or operate in industries prone to such incidents. - Q: Does my standard life insurance cover kidnappings?

A: Probably not. Always check specifics, but many basic policies exclude this scenario entirely. - Q: Can I purchase this individually, or must it be corporate-backed?

A: Both! Individual policies exist for freelancers, adventurers, etc.—you just need to shop around. - Q: What should I do if approached by suspicious strangers?

A: Report it immediately to authorities/your insurer’s helpline rather than engaging directly.

Conclusion

We’ve covered a ton today—from defining kidnap and ransom insurance to walking you through securing it and using it wisely. Remember, safety doesn’t mean paranoia; it means preparedness. So channel Optimist You (“This info could save lives!”) instead of Grumpy You (“Ugh, another expense…”) when exploring these options.

To recap:

- Risk assessment is key to choosing appropriate coverage.

- Review policies thoroughly and assemble emergency contacts.

- Stay calm and follow expert guidance during crises.

- Learn from success stories, so you don’t repeat failures.

And finally—a little dose of nostalgia: While prepping for anything unexpected feels daunting, treat it like caring for a Tamagotchi. Consistency keeps catastrophe at bay.